Lead Management in Insurance Industry

What is Lead Management?

A lead is an individual or company that shows interest in your products and services and could potentially become your customer. Lead management, a vital component of effective CRM (Customer Relationship Management) processes, is a systematic approach that involves capturing, tracking, distributing, managing and nurturing leads.

Having said that, every business is different and there is no one-size-fits all approach when it comes to lead management. Businesses are free to apply a set of approaches that work for them.

Based on our experience in implementing lead management systems, including those integrated with CRM solutions like SugarCRM, for an insurance company, typically the lead management encompasses the following key processes:

-

Generating leads through various digital and non-digital channels such as brand marketing campaigns, partners (banks, independent financial advisors, agencies, brokers), referrals, social media posts and ads, and corporate websites/microsites.

-

Segmenting leads based on their geographical location and interests in different product categories such as life, health, and general.

-

Distributing leads to the right financial advisors based on segmentation.

-

Qualifying leads by the financial advisors to follow up, find the interests and conduct proper find-fact.

-

Nurturing leads to keep the lead hot with sales activities like contacting and meeting the leads until conversion.

Lead Management in Insurance Industry

Insurance industry is a unique industry in a sense that many of the sellers a.k.a financial advisors or agents are not direct employees of the insurers. They are either independent or part of some agency and can be geographically distributed. Due to this immense distribution network, insurers can extend their reach to the vast number of potential customers. Of course, this also poses some challenges to an insurer on how it can better manage its leads, distributes the leads fairly and to the right people, ensure the leads are not wasted while still respects the financial advisors’ autonomy and has the overall visibility on what’s going on and takes actions when necessary.

Due the nature of insurance business and the challenges that insurers face, a centralized lead management system with an automated leads distribution and mobility support is crucial to the entire lead journey. This kind of system provides an insurer an organized way of classifying leads, automated method of distributing them to the right financial advisors, a streamlined lead qualification and sales process, as well as visibility and maintains contact with potential customers. This approach aligns with the evolving needs of insurers in partnership with SugarCRM, iZeno’s trusted CRM partner, and other CRM-related solutions.

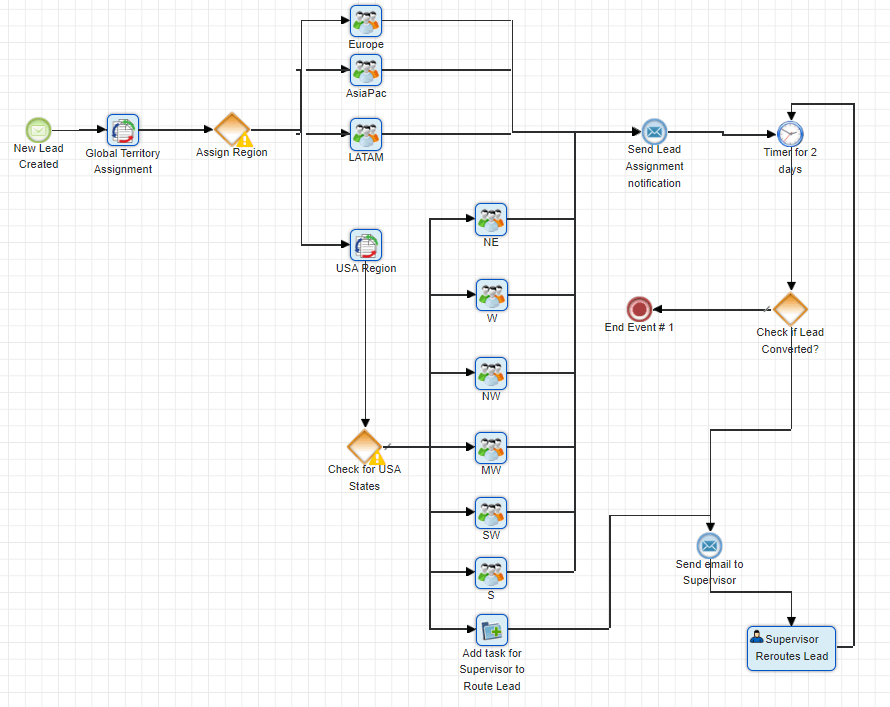

Assign the leads to the right financial advisors via automation.

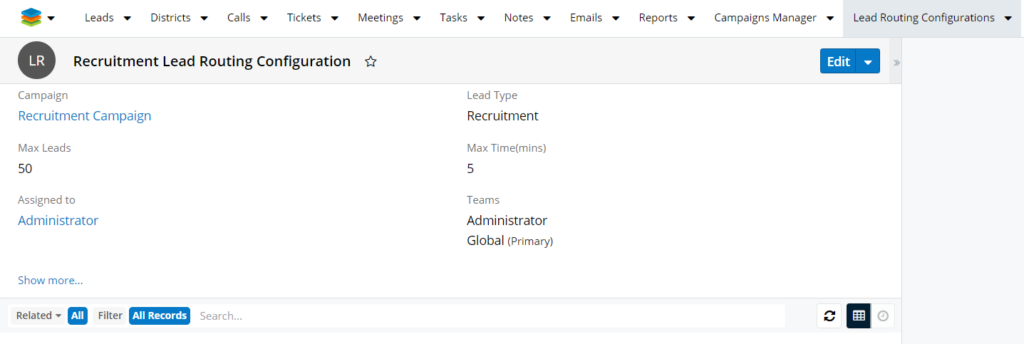

Leads can be generated from various digital and non-digital channels and they can be geographically distributed. All these leads should be pooled into a centralized lead management system to be further distributed, qualified and nurtured. When it comes leads distribution, it will only make sense to route them to the right financial advisors not only based on the matching of the product interest and the financial advisor product specialties but also the geographical location of the lead and the financial advisor and other important criteria. For instance, a lead that is located in Jakarta with interest in general insurance should be assigned to a financial advisor whose specialty is in general insurance and is based in Jakarta as well as taking other factors into consideration such as the capacity of the financial advisors.

As a result, a lead management solution should be shipped with capabilities of automatic leads distribution based on a set of configurable predefined criteria such as financial advisor specialties and geographical location or other important criteria.

Don't make the leads wait and keep the momentum going.

Insurance industry is competitive and when it comes to new leads, there is no time to waste as the prospects’ level of interest decreases at the speed of light. After an hour, they may have already gone cold and switched to a competitor. No leads should ever be wasted before qualifying them properly.

Therefore, it’s crucial for insurers to be able to keep the momentum going and define the optimal maximum time for a financial advisor to acknowledge an assigned lead before it gets reassigned to another financial advisor. This also encourages the financial advisors to react fast and be responsive before they lose their leads.

Empower the financial advisors with mobile apps.

Not all leads are sales-ready from the get-go especially for those that are not familiar with your brand and products. Many aren’t insurance products savvy either especially with overwhelming products with all kind of benefits. They take their time to do research and get to know your products before they make decision to purchase.

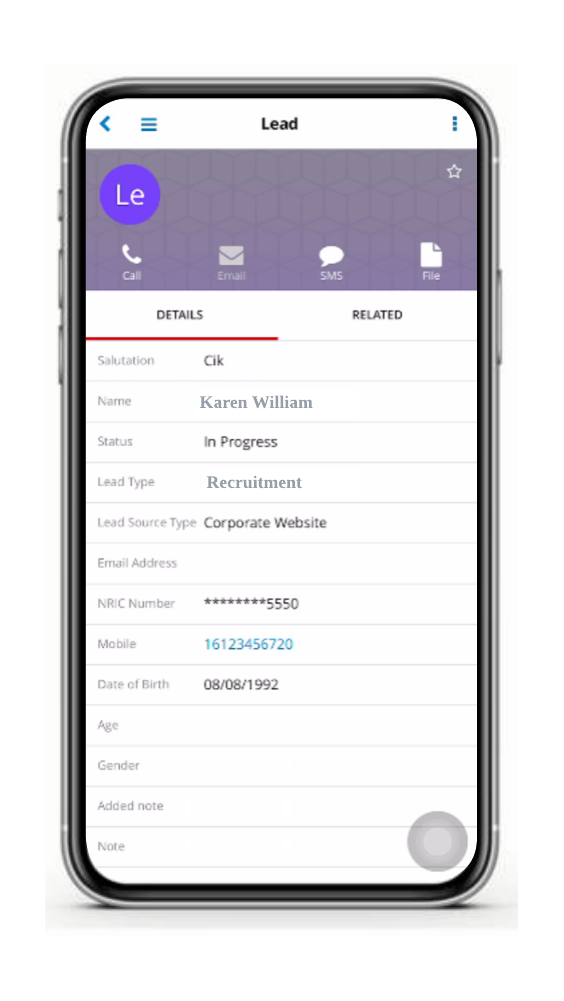

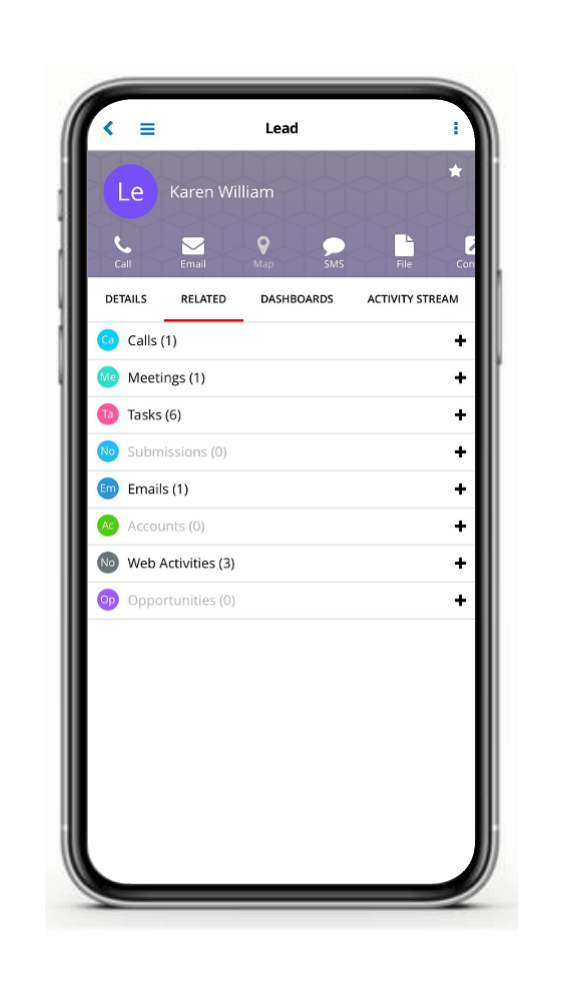

As a result, financial advisors will continue to play a vital role in helping the leads understand your products better, qualifying their interest and advising what would be the products that best suit their needs and budget. It is important for an insurer to upgrade its financial advisors capabilities to more effectively use digital tools and empower them with all the easily accessible information at their fingertips whenever they need them. For instance, financial advisors should be equipped with mobile apps so that whenever leads are assigned to them they are notified instantly through push notifications so that they can acknowledge them within an allowed time.

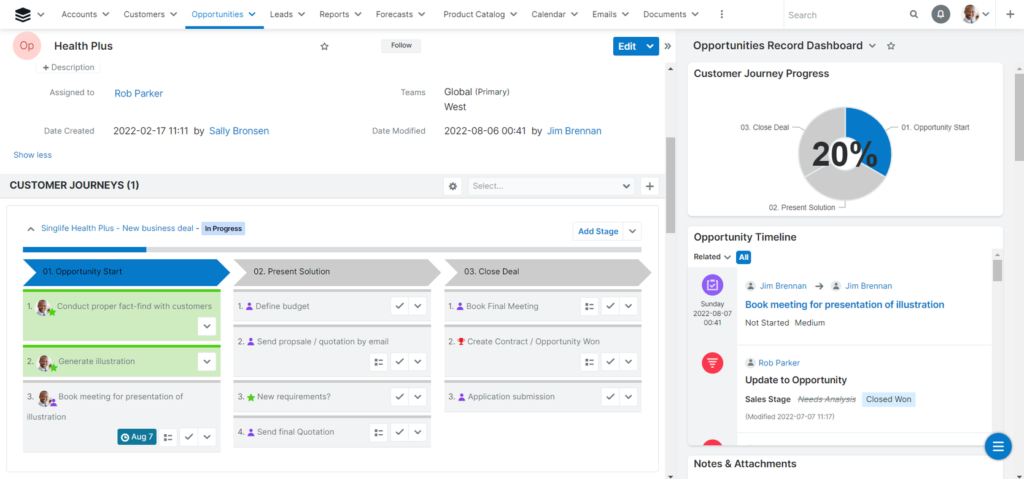

Guide the financial advisor through a streamlined process from leads qualification to sales generation.

It’s important for insurers to have a streamlined process that can guide financial advisors from qualification, nurture and closing. A streamlined process can keep your financial advisors on track and not to lose their focus.

A good lead management system should allow insurers to set standardized process templates based on important criteria. For instance, a lead is sourced from website may need to be handled differently than a lead that comes from referral.

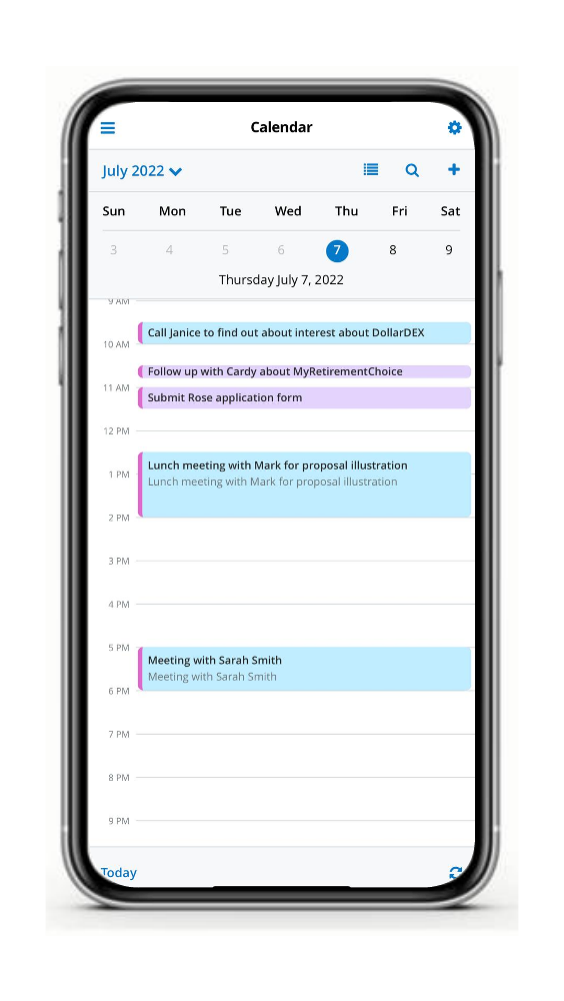

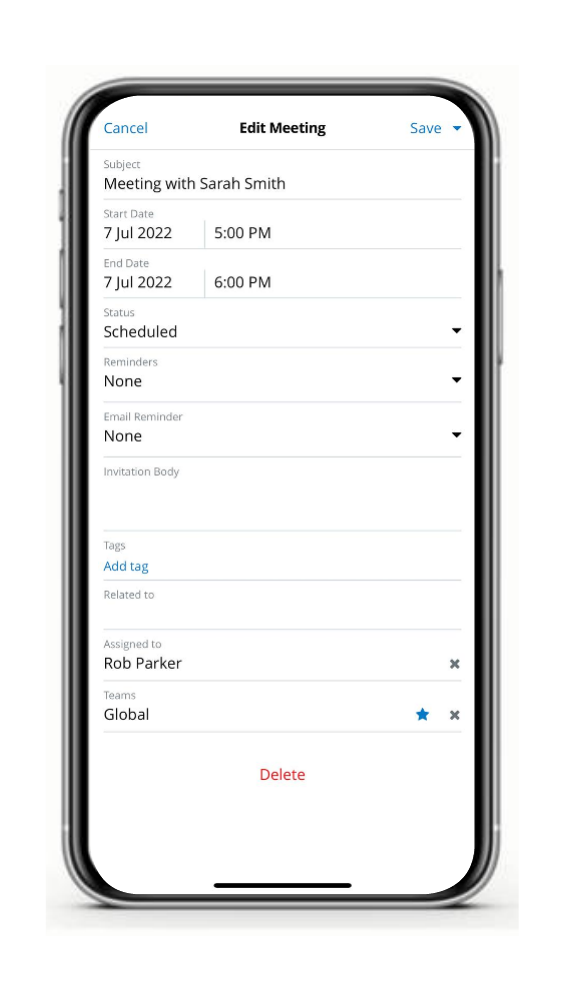

Allow financial advisors to manage and schedule their sales activities.

Financial advisors are required to guide potential customers from discovery to purchase within the timeline that fits their needs. Hence, they should be able to prioritize their leads and provide consistent communication until the prospect is ready to make a decision.

Having said that, financial advisors should be able to plan and record their activities through the mobile apps. This will allow the financial advisors keep things on top of their mind, review and revisit things when they need them.

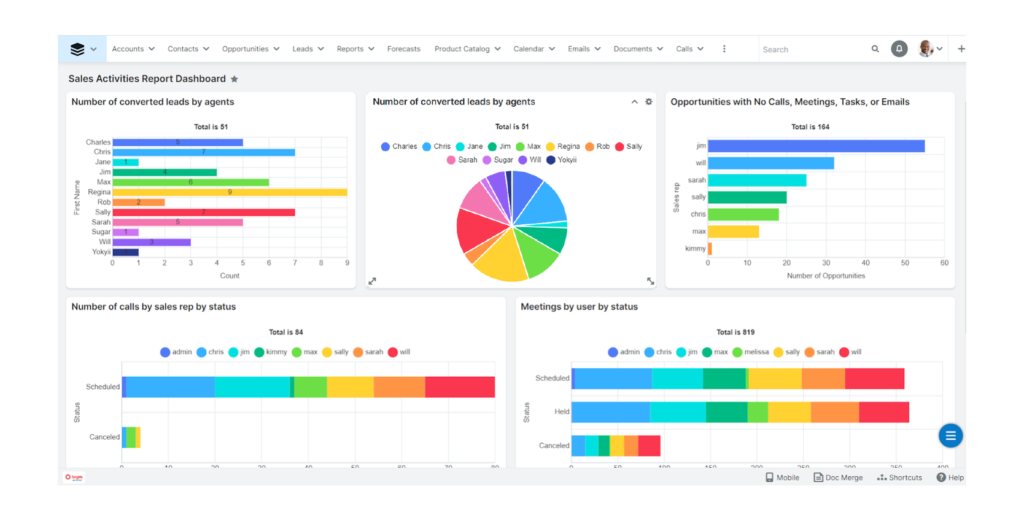

Monitor the sales pipelines and financial advisors productivity through reports and dashboard.

An insurance KPI dashboard provides a unique perspective on performance and efficiency of your financial advisors and allows you to monitor their productivity. These KPIs include but not limited to lead distribution, sales activities report, average lead acknowledgement time, conversion rate, and so on. These metrics enable the insurers to identify top performing and the underperforming financial advisors.

This will allow the insurer to plan improvement strategy for underperforming financial advisors through various learning and improvement programs and incentivise top performing financial advisors.

Key Recommendations

As next steps, followings are the key recommendations of a centralised lead management system in insurance industry.

- Gamifying the sales activities where points can be earned by financial advisors to encourage user adoption and boost the selling power. These points can be used by insurers to provide more attractive incentives and/ rewards.

- Centralizing end-to-end sales process from qualifying leads, managing opportunities, sales generation and policy contract issuance notification within one single platform so that your financial advisors won’t lose their focus by switching multiple platforms.

- Leveraging analytics for cross-selling and upselling.

- Integrating with telephony solution for call recording so that insurers can use them later for quality assurance and financial advisors improvement program.

- Integrating with popular social messengers like WhatsApp so that your financial advisors can manage all their sales activities within one single platform and you won’t lose your leads and customers even when some financial advisors are no longer with you.

SugarCRM Elite Partner

iZeno is an Elite Partner of SugarCRM

As a SugarCRM Elite Partner for the past 10+ years, iZeno team of 30+ certified SugarCRM experts in Singapore, Malaysia, Indonesia, Thailand & the Philippines can help you get started by conducting discovery workshop for users and administrators, recommend the appropriate SugarCRM subscriptions (Sugar Sell, Sugar Serve, Sugar Market, Sugar Professional or SugarCRM Enterprise Editions) for your business.

Our certified SugarCRM consultants can assist your IT team in training, implementation & Configurations according to the industry Best Practices.