All banks who operate in Indonesia, both local ones and branches of overseas banks, are obliged to send regulatory reports to Bank Indonesia. Reporting banks can either upload their reports to BI online network, or just bring a disk with the data to BI. BI requires a number of reports, which should be sent every week, month, every three months, and every year. For the employees of reporting banks, it usually means plenty of time and effort spent on preparing these reports.

Each of these reports must be prepared according to the particular form (provided by BI) and submitted at exactly the right time. If a reporting bank fails to submit any of these reports on time, it will receive a warning letter or even a fine. For example, the Cash Flow Report is to be submitted weekly, every Friday (or the next working day, in case of a national holiday).

As for monthly reports, there are eight of them. Monthly reports are submitted on the fifth day of each month (or the next working day, in case of a national holiday). Credit Card & E-Money Report, Custodian Activity Report, Local Credit Report, Delivery channel e-banking report… All they take time to prepare.

So do three tri-monthly reports (which are submitted on the 15th day of every third month) and one yearly report.

For online submission, a special system is used, called LKPBU (Laporan Kantor Pusat Bank Umum). If LKPBU doesn’t work properly, e. g. due to some technical reasons, the reports should be submitted offline.

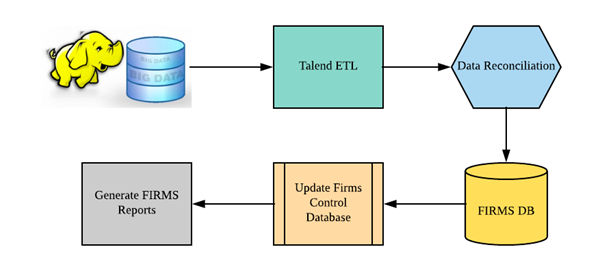

At the diagram below you can see how exactly the reporting process works:

iZeno can relieve reporting banks from a good share of problems with this reporting.

With iZeno, reporting banks can be absolutely sure that all reports will be delivered on time.

PT iZeno Teknologi Indonesia, a subsidiary of iZeno Pte Ltd, successfully works in Indonesia and other countries of South East Asia. Both the head company and the branch have extensive experience in dealing with the needs of our customers from the financial sector. We know what problems they face, and we are able to solve them effectively and quickly.

The LKPBU project proved a success because:

- It provided ETL Tools, i.e. special means used for extracting, transforming and transferring the data in various formats from the system of the reporting bank into a special reporting database;

- It had a special means for handling metadata mapping;

- It ensured integration with LKPBU Service Endpoint for reliable online delivery.

- Thanks to Data Quality, users could properly prepare the business-related data before loading them into the system.

- The close-knit team of experts on Data and Reporting who knew the requirements from A to Z.

- Thanks to feedback from numerous business users, it was clear how to improve the project, making it even more suitable for the business users’ needs.

iZeno developers make use of Agile methodology, which enables them to customize the system, so that it meets all the customer’s requirements. Whatever the problem, iZeno will solve it in the optimal way.